Private Equity

Private Equity

When it comes to value creation, leadership matters.

We are a global leadership consulting firm, dedicated to helping executives, teams, and next generation leaders master the art and science of leadership.

At RHR International, our team of performance psychologists, coaches, and former operators, bring a deep systemic understanding of individual human behavior, team dynamics, and optimal performance.

We are proud to have partnered with some of the world’s most recognized private equity firms and their portfolio companies.

We seek to unlock the potential in all leaders.

When it comes to value creation, leadership matters.

Learn how RHR helps private equity firms build scalable leadership to achieve value-creation goals.

Why RHR?

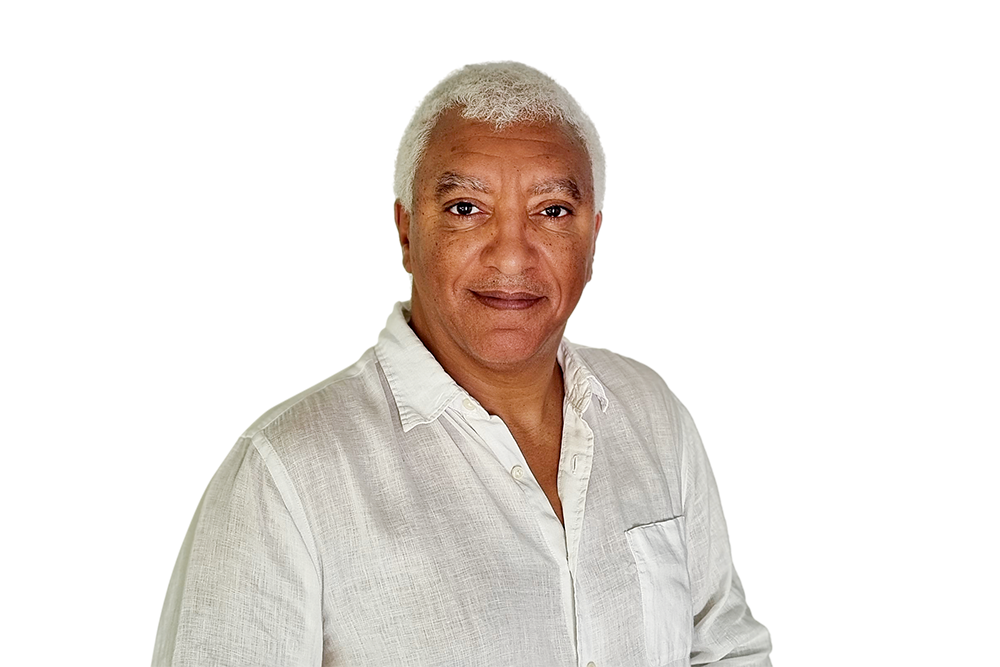

Hear RHR Partner and Head of Private Equity Nick Twyman talk about the exceptional quality of RHR leadership consultants working with clients in the PE arena.

Who We Help

We work with your leaders, teams and cohorts to drive leadership impact and performance, to help you achieve your value creation goals.

Individual Leaders

- Match the right executive talent with the right roles

- Integrate new hires

- Create robust leadership pipelines for scalable leadership

Executive Teams

- Create focus and accountability

- Build high-performing teams that are aligned on key priorities

The Board

- Establish seamless alignment between the board and management team for high-impact performance

Operating Culture

- Create an operating culture focused on driving results

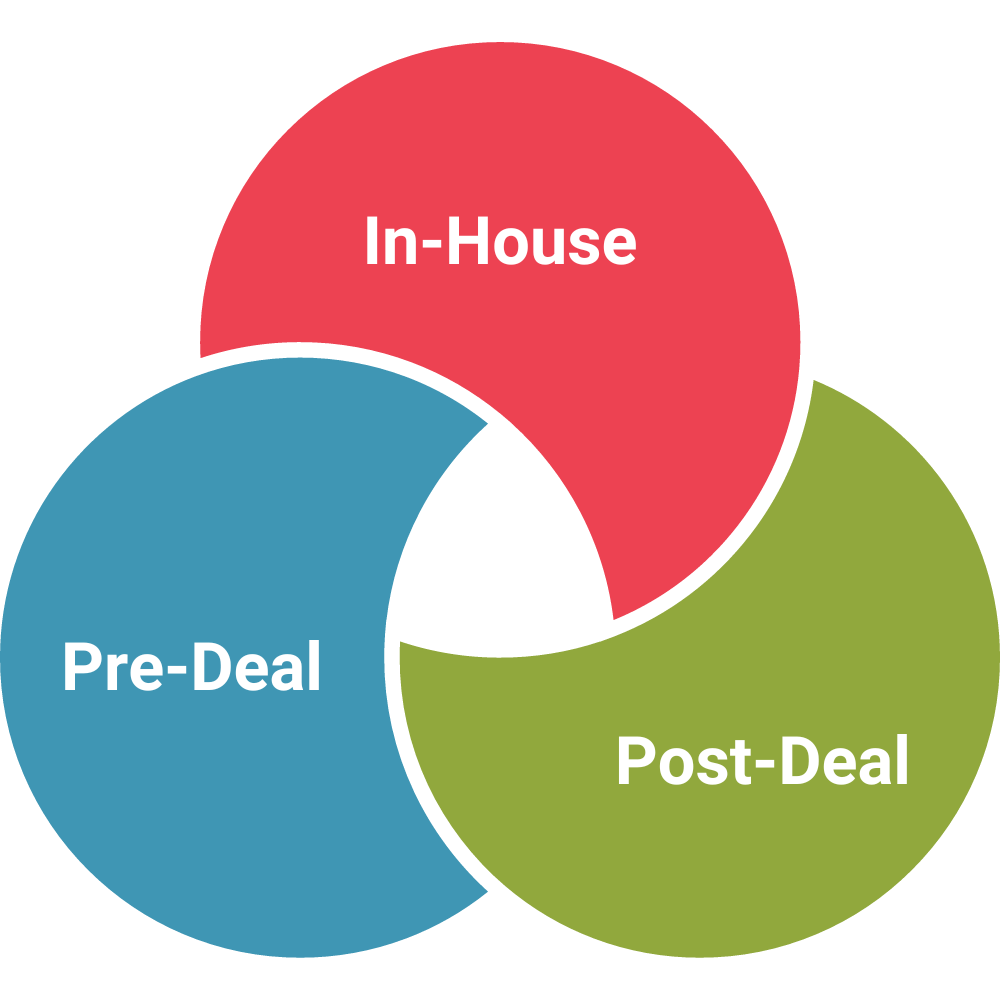

Our Solutions

1. In-House

Work with your leadership team to assess and develop the essential skills and behaviors required to deliver high performance2. Pre-Deal

Due diligence to assess the potential of the leadership team you are looking to back

Roadmap of areas of strength and weakness that can be addressed or developed immediately upon purchase

3. Post-Deal

Individual, team and board assessment

Leadership development

Leadership selection

Succession planning for CEO and senior executives

Accelerate alignment of the portfolio executive team with the PE company

Common Challenges Faced By Private Equity Companies

Assessment

Who has the ability to scale with the organization?

How can we set up external hires for success?

Our Solution

Our assessments provide alignment on role requirements, uncover leadership strengths and gaps, and deliver insight into scalability.Learn how to onboard new leaders and focus their development.

Executive & Cohort Development

Our Solution

We deliver targeted executive coaching and cohort development (within and between portfolio companies) to build the muscles required to lead at scale.Team Effectiveness

Our Solution

Our benchmarked survey identifies gaps in performance that inform proven interventions to strengthen team functioning and impact.Board Effectiveness & Alignment

Our Solution We deliver insight and development reflecting how the board needs to evolve as the company enters a next phase of growth; interventions accelerate alignment and set expectations between board members and management.

Operating Culture Diagnostic

What are the barriers to scale?

How should we fix them?

Our Solution Our operating culture diagnostic identifies bottlenecks in scalability. Interventions remove obstacles to growth and enhance enablers.

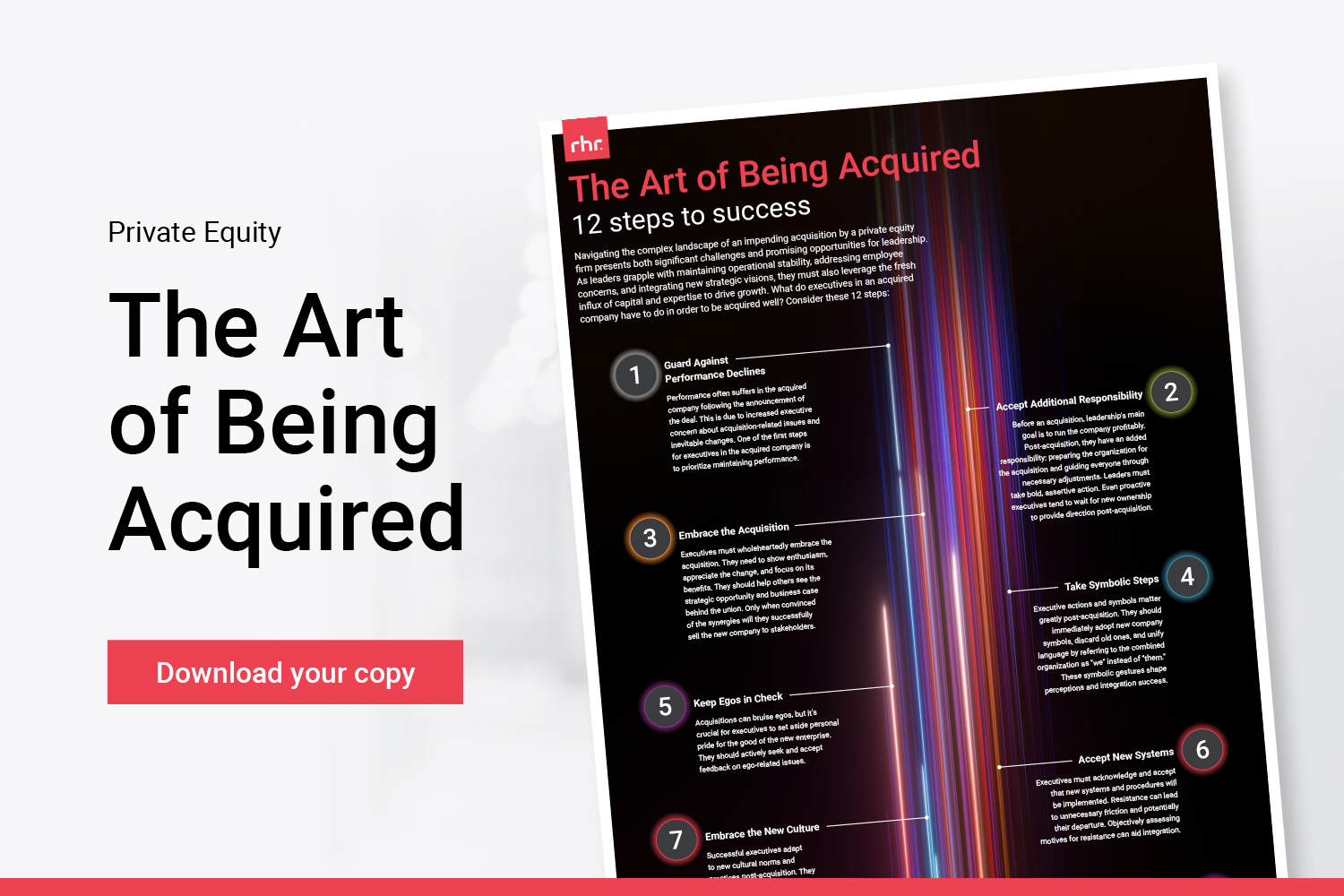

The Art of Being Acquired

Download “The Art of Being Acquired,” our new infographic illuminating a crucial aspect of private equity leadership.

Let’s Talk

Our global network enables in-person and virtual support for our clients worldwide. Get in touch to find out how RHR International can help you unlock the potential in your leaders today.

Robert Abramo

Head of Business Development

rabramo@rhrinternational.com

+1 215 237 8620

Our Team

Our global team of leadership coaches, consultants and advisors have decades of experience working with hundreds of private equity clients and their portfolio companies. Once we understand your objectives and specific pain-points, we match the right expert or team of experts to work with you across assessment, coaching, advisory, and leadership development to drive your leadership effectiveness and capability to work in high growth, demanding businesses.

Let’s Talk

Robert Abramo

Head of Business Development

rabramo@rhrinternational.com

+1 215 237 8620

Our Experience

We have over 25 years of experience helping over 200 private equity firms to assess, coach and develop their leadership talent. We offer a global solution, with specific areas of strength in the UK, Europe and North America.

Let’s Talk

Our global network enables in-person and virtual support for our clients worldwide. Get in touch to find out how RHR International can help you unlock the potential in your leaders today.

Robert Abramo

Head of Business Development

rabramo@rhrinternational.com

+1 215 237 8620

Testimonials

For over 25 years we’ve been helping our private equity clients to improve their leadership effectiveness and performance to meet the exacting demands of working in a high growth, high pressure environment.

Let’s Talk

Robert Abramo

Head of Business Development

rabramo@rhrinternational.com

+1 215 237 8620